You can read this article in Swedish.

If you’re a Swedish merchant you’re already familiar with Autogiro and you surely understand the concept of automatic monthly withdrawals. The ease of collecting regular subscription payments, fees, or charity donations is what makes Autogiro so popular and favoured in many cases. Did you know that Autogiro was Sweden's first automated payment service? And surprisingly, it has been growing yearly by 10% over the past 25 years.

However, there is one downside to traditional Autogiro payments: the time-consuming process of signing up for direct debit mandates. Whether filled out on paper or filled in online, there is a high chance of form abandonment due to the time needed to sign up for the mandate. And even if the client completes the registration process, there is a high possibility that some details might have been filled in incorrectly, making the whole procedure even more lengthy.

This is why at Waytobill we looked for a way to digitalise Autogiro. We wanted to help merchants reap the benefits of automated payments. Still, we knew we first had to come up with an idea to make Autogiro registration easier, faster, and more efficient. And this is how we created Digital Autogiro.

What is Digital Autogiro?

Digital Autogiro is a digital way of creating new direct debit mandates in Sweden that helps merchants increase conversion and retention rates, especially when it comes to telesales (we’ll cover online purchases and field sales too!). Digital Autogiro allows merchants to prepare Autogiro mandates that are sent to customers for signing, without the need to fill out lengthy paper forms. This speeds up the registration process and improves conversion rates.

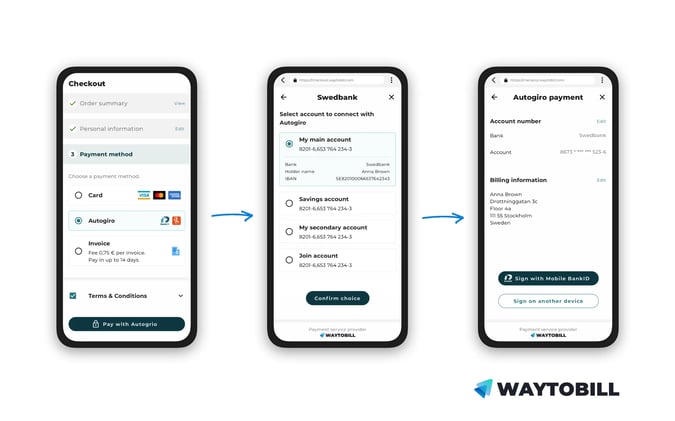

When your prospects decide to subscribe to your product or service on a monthly basis they can choose Autogiro as their preferred payment method. Clients will be asked to choose their bank from a list and then select the account they want to use to make the monthly withdrawals. They will be then redirected to a screen where they can confirm their payment and mandate with Mobile BankID. Note, that with Waytobill’s Digital Autogiro clients access their online banking, directly from the form and the account number is fetched automatically. Thus, clients set up the Autogiro mandate in one process, without having to manually look for their account number.

As you can see, Digital Autogiro is a transparent payment option that reassures clients that their payments are protected and secure.

We created an informative infographic about Digital Autogiro so that you can have all the information handy at all times. Download it now!

How to use Digital Autogiro?

Digital Autogiro can be used in the following checkouts:

Digital Autogiro in telesales

Telemarketers know better than anyone else how difficult it sometimes gets to close sales… Now think about sending paper forms to the clients that want to proceed with Autogiro and waiting to receive them back, all filled out. Chances are, you might never see them again or that they'll come back with incorrect information or signatures missing and will have to be sent to customers once again.

However, by switching to online Autogiro, you will start closing your sales much easier and faster!

Did you know that Waytobill is integrated with the most popular telesales systems? Find out more about our integrations and start improving your conversion rates today!

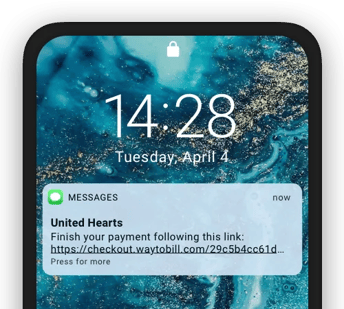

When coming to an agreement with potential customers, telesales agents can send a text message directly to the client’s phone. And because the SMS comes from a telesales system, the form is automatically prefilled with the prospect’s information. It results in a much quicker and simpler sale. By clicking on the link, the user is redirected to Waytobill's online checkout where they choose their preferred bank account and securely confirm the direct debit mandate by signing in with Mobile BankID.

Digital Autogiro in online sales

Digital Autogiro is also a popular payment method for online sales, particularly for charities and subscription-based businesses. Imagine a charity donation site with three different donation amounts that you can choose from. Whatever package you select, you will be redirected to an online checkout page where you can choose Autogiro as your preferred payment method. This option works fantastically for memberships, subscriptions, insurance, and lotteries, too.

![[EN] Fundraising platform visual - just iMac@1x](https://blog.waytobill.com/hs-fs/hubfs/%5BEN%5D%20Fundraising%20platform%20visual%20-%20just%20iMac@1x.webp?width=473&height=394&name=%5BEN%5D%20Fundraising%20platform%20visual%20-%20just%20iMac@1x.webp)

The image shows an example of a charity plugin designed by Waytobill. This simple design allows you to clearly see different donation or subscription options so that the user can easily understand what they’re subscribing to.

“The best thing about Digital Autogiro is the checkout flow. Customers don’t need to share their bank account numbers or log into their Internet banking. Let’s not forget that all you need to complete your purchases is a mobile phone, especially when using QR codes” - Christian Iversson, Head of Sales at Waytobill

Digital Autogiro in field sales

If your business relies on field sales, you can still add Digital Autogiro to your payment options. Are you wondering how that’s possible?

If field sales play a big part in your strategy, you know that the amount of cash people carry has been continuously decreasing. Actually, your revenue might have been dramatically affected by this change. And as effective as field sales may be, particularly for charities, the lack of cash in your audience’s pockets is dooming. But here’s a solution to your problem.

Once you find prospects interested in your product or organisation, invite them to scan a QR code that will redirect them to your online checkout. This is a perfect way to convert interested people into paying monthly customers! Why? You get to convert users who:

- Carry no cash

- Are in a rush

- Don't want to share personal information on the street

- Want to give it more thought

By scanning the QR code with their mobile devices they can reopen your checkout anytime they want, and therefore, become paying customers, subscribers, or donors! Watch the following video to better understand the concept behind QR codes and Digital Autogiro.

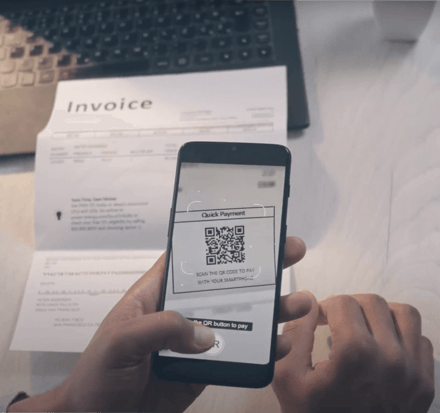

Digital Autogiro on paper sales letters and invoices

Sales letters are still relevant for many industries, especially non-profit organisations that highly rely on physical communication. Many of them have been looking for ways to offer more recurring payment methods that would help them establish a regular monthly cash inflow. But how can you add Digital Autogiro to sales letters? The answer comes in the following image:

Add personalised QR codes to your sales letters that will redirect interested users to your online checkout.

And why should the QR codes be personalised? You already have the name and address of the person you’re sending your letters to; and by pre-filling the form for them, you provide them with a faster and more user-friendly way to become a subscriber, donor, or a new customer of your business. Find out more about our solution.

Advantages of using Digital Autogiro

Conversion and retention are frequent problems across all industries. And problems need solutions. By incorporating Digital Autogiro into your telesales, online, or physical sales checkout you get to:

- Increase conversion and retention rates - the easier the payment option, the more people you’ll convert and retain as no action is needed from clients that subscribe to your product, service, or charity donations, until the moment they wish to cancel the subscription.

- Improve customer lifetime value - various studies have shown that subscription donors and customers stay committed to the brand for a longer period of time.

- Avoid problems caused by expired cards and unpaid invoices - payment cards typically expire anywhere from three to five years after the issue date. Expired credit cards mean unpaid bills and donations, and cancelled subscriptions. By opting for Digital Autogiro you eliminate this problem as customers don’t switch bank accounts as often as cards.

- Improve customer satisfaction - by offering a seamless experience, you improve customer satisfaction, which might result in positive word-of-mouth referrals.

Do you have more questions about Digital Autogiro? Or maybe you want to share your story of incorporating Digital Autogiro into your business? Either way, don’t hesitate to contact us!