What is Autogiro in Sweden? Increase Conversions for Subscriptions

What is autogiro in Sweden? Uncover the downsides of traditional autogiro and learn about the digital solution that's revolutionising payments in...

.png)

Companies no longer seek hot leads - they want telesales agencies to deliver closed deals. Here's how to get on top of your game with digital signing.

At Waytobill, we pride ourselves on providing unparalleled support and guidance, when telesales agents embark on their journey with Waytobill’s payment solutions. Through countless conversations with our users, we have identified recurring questions and common inquiries that arise when getting started with digital signing. In response, we decided to gather them and create a guide that will help those venturing into the realm of digital signing in telesales. So whether you’re a novice seeking guidance or an experienced user with lingering questions, take a look at this FAQs piece. Before we dive in, let’s find out what digital signing is.

Digital signing in telesales refers to electronically signing agreements and confirming payments during a telesales interaction. It uses technology to verify a person’s identity, eliminating the need for physical paperwork or handwritten signatures.

When it comes to digital signing with Waytobill, our payment plugin integrated with telesales systems and CRMs allows agents to send secure payment links directly to a client’s mobile phone. By clicking on the link, customers open up a checkout that not only facilitates the payment process but also enables them to confirm the agreement. In Sweden, for example, to confirm an order and sign digitally with Waytobill, customers use their BankID. This allows us to ensure the authenticity and integrity of the signed agreement, as well as adds an additional security layer for the customer.

Digital signing in telesales offers several advantages, including increased efficiency, reduced paperwork, faster turnaround times, and improved security. It also allows sales teams to streamline processes and close deals more quickly while maintaining a legally binding record of the transaction. Furthermore, thanks to digital signing, telesales agents can sign customers to recurring payments thanks to Digital Autogiro and AvtaleGiro. This offers businesses the opportunity to increase conversion and retention rates, as well as customer lifetime value.

Now that we know what digital signing is, let’s dive into the most frequently asked questions when getting started with Waytobill and digital signing!

One of the most common inquiries that we receive when agents first start using our payment plugin is “It doesn’t work, it’s too difficult to get customers to sign”. We’re about to show you why this is not the case.

Our data indicate that merchants typically lose between 50% and 80% of orders after customer expresses their intent to purchase. With our digital signing feature, merchants can recover up to 50% of those lost orders.

But why do many agents struggle to get customers to sign?

Telesales agents, especially those working for telemarketing agencies, are accustomed to generating leads rather than securing closed deals. In the past, their job was done as soon as the potential customer said the magic “yes”. However, with our new approach, telesales agents must adapt and realise that their role now extends to guiding the lead through the signing process.

Once a potential customer agrees to subscribe or donate, telesales agents use their sales system to send a text message with a payment link.

By following the link, the customer is redirected to an online checkout where they can confirm the subscription details, and pre-filled personal information, choose the payment method and confirm the order by signing in to BankID.

According to Swedish law, telesales agents must disconnect the call while the customer is accepting the agreement. However, nothing stops you from accompanying the customer up to that point. You can also talk the customer through the process before sending the link and call back afterwards to offer further assistance if you see that the checkout is still pending. However, it is important to remember that the customer has the right to make a well-thought-out decision that may take some time. Besides, each customer has the right to exercise the 14-day regret period, which is something that they should be reminded about too as it can help reduce the anxiety of accepting the order right away.

So how do you get more customers to sign the agreement? It’s as simple as adjusting your script and explaining the benefits of digital signing to the customer. Highlight the elimination of lengthy paper forms, signing documents, and sending them back and forth. Make sure you point out the ease of use and convenient checkout experience. By doing so, you’ll effectively get the customer on board! Then, instead of just saying “I’m going to send you a payment link, thank you and goodbye”, provide a step-by-step explanation of what they can expect once they open the link. Let them know they’ll have an opportunity to review subscription details and personal information before signing.

From a business perspective, we understand that telesales agencies often operate on a commission basis. If a client requests you to close deals over the phone, make sure you negotiate the terms and conditions of the deal. Look at it as your chance to generate more revenue for the agency and your client.

Telesales agents often encounter customer resistance when it comes to providing email addresses. While it’s true that consumers are cautious about their data online, it’s worth noticing that email communication remains the preferred channel for brand interactions.

Our experience has shown that customers drop off whenever they must fill in forms with personal details. A great way to increase your digital signing conversion rate is to ask the customer to provide their email address over the phone so that you can introduce it to your telesales systems before sending out the payment link. With that step, the checkout will be pre-filled with the email address and the customer will only have to check if it’s introduced correctly.

.webp?width=307&height=518&name=Charity%20-%20Personal%20info%20mockup%20-%20black%20(3).webp)

As previously mentioned, before sending the payment link and hanging up you should explain what steps come next. If the customer hasn’t provided you with their email address, specify that they will be asked to introduce an email address themselves in order to receive a payment confirmation. You may want to add that it’s a standard practice and it’s the best and most convenient way to deliver order confirmation to the customer. Remind customers that by receiving the email they will be able to check the subscription or product details at any time or receive customer support if they ever need guidance or help with the product.

Another common concern raised by agents is the belief that digital signing doesn’t work for older customers. However, our constant feedback channels reveal that Waytobill’s checkout is intuitive for customers over 60 years old. Furthermore, our usability study supports this, showing that 83% of users in their 60s and 90% across all age groups strongly agree that the system is easy to use.

While it's true that elderly customers may require additional guidance and clearer explanations to complete the orders, their age should not be seen as an obstacle. What we do know is that elderly segments of customers take longer to finish the checkout because they are more careful than younger demographics when it comes to completing online transactions. It is essential, however, to ensure that the customer is using a smartphone. If that’s not the case, you may need to send them the payment link via email.

Still not convinced? Let’s consider a use case we worked on with HRF, a non-profit organisation dedicated to empowering and protecting the interests of the hard-of-hearing community in Sweden. According to HRF, the majority of their donors are elderly individuals, and the organisation was unsure if they would prefer receiving a traditional letter or a digital checkout solution. HRF offered digital checkout to donors up to 75 years old and 50% of them chose the digital checkout.

Ensure that your agents have a deep understanding of the product and can empathise with customers while also building trust. Analysing conversion rates for our merchants, we have observed that organisations with the highest conversion rates (50-75%) are those whose telesales agents can connect with the product or the problem it solves. Therefore, we recommend that sales teams implementing digital signing give themselves time to learn, evaluate, and adapt their processes, enabling each agent to find an effective way of guiding prospects through the conversion funnel.

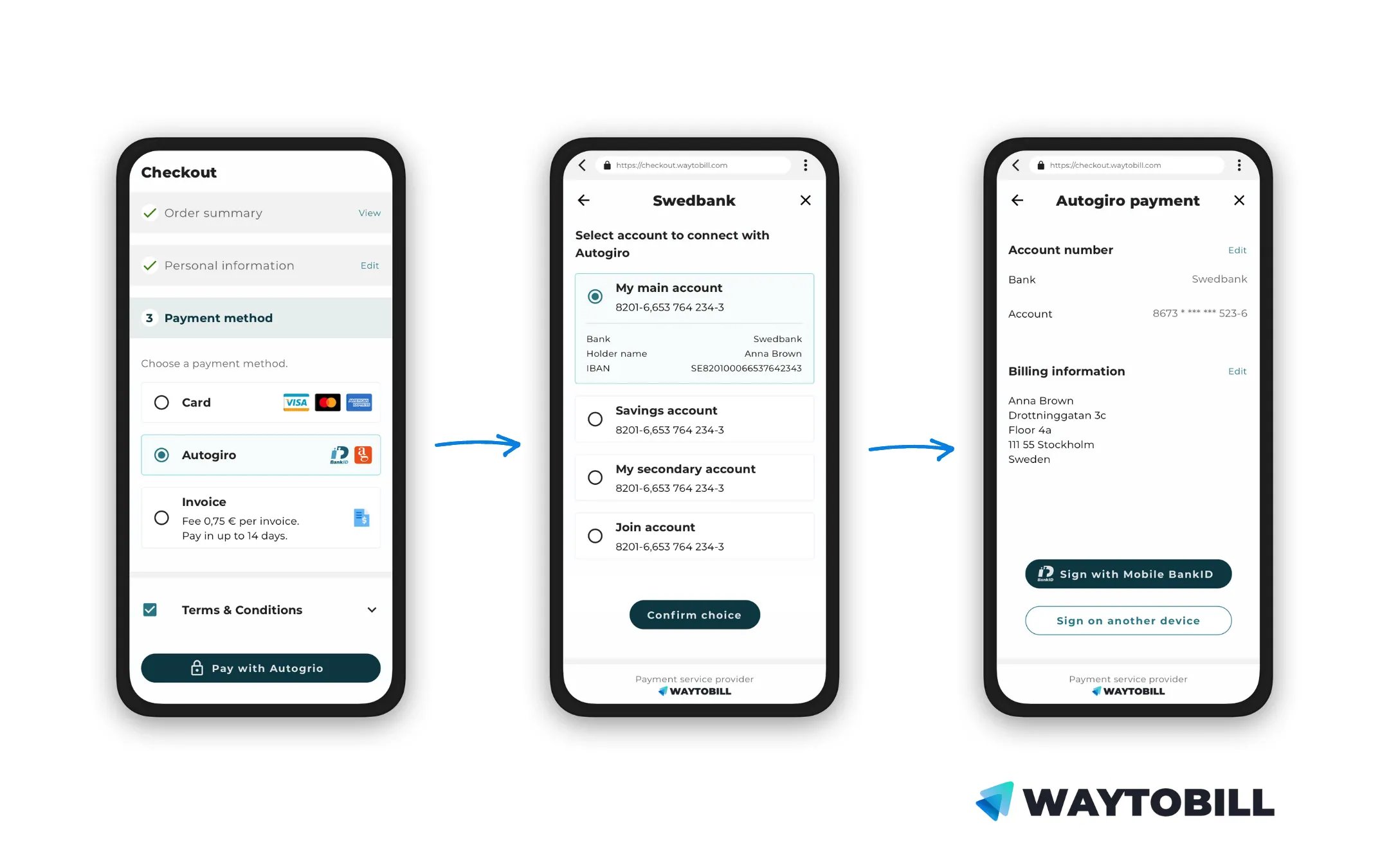

Some of our merchants have expressed concern that the digital signing process involved too many clicks, leading to customer drop-offs. We continuously monitor user behaviour to find out the best ways to optimise customer journeys. It’s worth noting that a 2020 study of the 13 largest clothing e-commerce sites, revealed that the number of clicks required for a purchase and checkout ranges from 15 to a maximum of 25, whereas Waytobill requires only about 12 clicks to be finished.

.webp?width=2398&height=1110&name=Autogiro%20flow%20-%20updated@1x%20(1).webp)

Moreover, based on our research, customers are generally more willing to accept a higher number of clicks if the information is pre-filled for them.

The best way to provide your customers with a positive checkout experience is to ensure that all their personal information is correctly filled in before you send a payment link. Make sure there are no spelling errors and that everything, including the email address, is introduced in your system.

We want to emphasise that Waytobill’s checkout has been designed to be intuitive and easy to navigate and we’ve made efforts to minimise the number of clicks required. Therefore, all the clicks involved in the checkout solution are mandatory steps to provide a secure transaction.

Swedish BankID is a personal and easy method of secure electronic identification and signing online. All individuals with a Swedish national identification number can sign up for BankID. It’s the single largest service used in Sweden, utilised by 94% of smartphone users.

Some telesales agents have raised concerns about customers potentially refusing to use their BankIDs but it’s important to understand the benefits and widespread acceptance of this identification method.

In Sweden, BankID is the preferred and widely accepted method for confirming the identity and signing documents online. It has revolutionised online transactions in Sweden, offering convenience, security, and trust in digital interactions. Make sure you point out that signing with BankID eliminates the need for physical paperwork, printing, scanning, or mailing documents. Customers can complete the process quickly and easily from the comfort of their own homes and start enjoying the products or services without delays.

However, the key to success is to sell your products and services to the people genuinely interested in your offering. By targeting your effort towards the right audience, you can effectively communicate the advantages of using BankID and address any concerns they may have.

Some of our merchants pointed out that they believe the link should be valid for longer than 24 hours, as customers sometimes take longer than a day to complete the checkout process.

It’s important to note that 24-hour validity is a standard choice for most payment companies, primarily driven by security considerations. Additionally, some banks allow only seven minutes to complete online transactions!

Apart from providing security, we see the 24-hour checkout validity as a way to manage order accuracy and pricing. Some telesales agencies send out checkout reminders, which can include a new checkout link.

Based on our experience, we have observed that customers who don’t complete the checkout immediately or within a few hours most often drop off, lacking the motivation to finalise the checkout and proceed with payment. Therefore, if you notice that checkout is still pending, it may be worth resending the payment link or picking up the phone and calling your potential customer before the link expires.

To address this issue effectively, it’s important to emphasize the value and benefits of completing the checkout promptly. Highlight any time-sensitive offers, limited availability, or exclusive incentives that customers might miss out on if they delay the process. By creating a sense of urgency and demonstrating the advantages of timely completion, you can encourage customers to take immediate action.

This brings us to the end of our telesales and digital signing FAQs! We hope you now have a better understanding of the process and know how to address certain issues. However, if you still have questions, make sure to contact us!

Take control and digitalize your payments. Contact us today! Your effortless checkout journey awaits.

What is autogiro in Sweden? Uncover the downsides of traditional autogiro and learn about the digital solution that's revolutionising payments in...

Wondering what Digital Autogiro is? You're at the right place! Learn all about this recurring payment method and discover the advantages of online...

Find out all you need to know about payment digitalisation and learn how to migrate your paper-reliant customer base to digital recurring monthly...