Waytobill answers to the rise in subscription business models and boosts its payment options by adding Digital Autogiro to its portfolio, a core asset in the Swedish market to improve efficiency in recurrent payments.

Waytobill shakes up the digital payment world by adding Digital Autogiro to its checkout

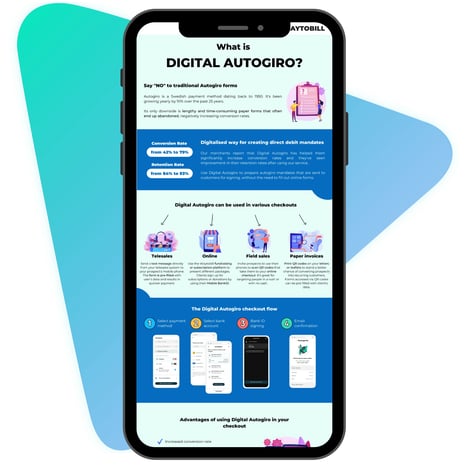

With the classic paper autogiro, the conversion rate can be as low as 40% when it comes to customers finalising their payments. According to our user studies, by using Waytobill’s Digital Autogiro option, a company can increase their amount of subscribers, members and monthly donors by about 10%. Thanks to the unique features of Waytobill, companies can increase their conversion not only through online channels but also support their digital models with in-field, social media and telesales campaigns. This incrementation will significantly boost companies' sales volume and increase their profitability.

As a result, new companies and existing ones that want to transition to the subscription model can do it effortlessly and seamlessly, erasing any friction, in just one simple click.

Download a complete infographic to learn all about Digital Autogiro.

Waytobill has become a core asset in the quest for helping companies fully develop their potential in the subscription industry. Thanks to this, the company has positioned itself as a driving force in the telesales checkout sector with a strong unique product.

Keen to find out more about Digital Autogiro? Contact us!

Waytobill is a Swedish user-friendly payment plug-in system for telesales and subscription companies. The smart way to increase the sales conversion and profitability of subscription businesses. By specializing in telesales checkout with a tailor-made approach, we can help businesses increase the number of paid orders and increase their recurring volume by extending the subscription period.

Magnus Bendelin, CEO, and Alejandro Pino, CTO, are the founders of Waytobill. Magnus has previous experience in the finance and fintech industry both regarding startup and scaleup. Alejandro has experience in tech development and product development within the payment industry.