With the new year around the corner, now is an excellent time to take a look at the financial market and analyse what has happened in the payment field in 2022. As specialists in the Swedish payment market and partners of significant financial institutions, we have inside knowledge of the ever-changing industry and we’ve been seeing many changes that have or are going to revolutionise the payment market.

We have also taken this opportunity to look into the future; here are five trends that we expect to see in the Nordic payment market in 2023.

Are you looking for information regarding payments in 2024? Head to our 2024 Payment Trends in the Nordic market for the newest insights and predictions!

1. Payment digitalisation on the rise

Traditional payments and communications are still prevalent in Nordic countries but organisations across all sectors have identified the need to digitalise communications and payment methods. The concept of a cashless society has taken over the Nordic region, with 91% of the Swedish population no longer using cash. Payment digitalisation goes hand in hand with the leading Nordic bank partnership, P27 Nordic Payments’ announcement of the end date for cash payments and paper slips in March 2024. Organisations and businesses that still rely on paper forms and cash payments will implement innovative payment methods over the next 12 months.

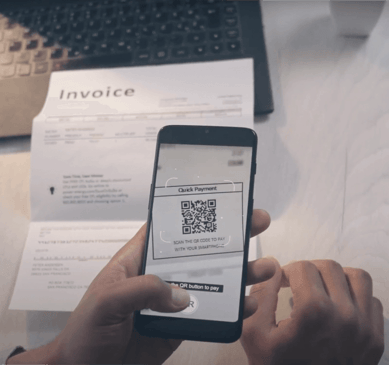

A great example of digitalising traditional payments is QR codes that are frequently used by companies looking to increase conversion on paper invoices and sales letters. By scanning the code on paper, organisations convert prospective customers within seconds. Such QR codes can lead users to online checkouts pre-filled with their personal information. A prospect can become a client right there and then.

2. Consumers opt for convenient payment methods

The XXI-century customer has excellent access to information, resulting in more well-informed decisions. Consumers have also become more selective when it comes to payment methods, opting for convenience and avoiding time-consuming payments. In 2023, effortless payment options will attract more users, as 98% of consumers are interested in using face recognition or other biometric resources, which is one of the reasons for the great success of Swish, MobilePay, and Vipps.

3. Cashflows and personal payments become instant thanks to MobilePay, Swish and Vipps

Cash flow management used to be far away from instant. However, thanks to MobilePay in Finland and Denmark, Swish in Sweden and Vipps in Norway, it can now be nothing less than instant. Local payment methods in Nordic countries boast more than 13 million users, being the preferred payment option for many of them. The ease of transferring money within seconds is especially important in case of emergencies, while merchants get to manage the cash flow with much more ease, reducing the risk of payment reversal due to insufficient funds.

4. Digital Autogiro gains relevance and traction

The Swedish autogiro has been growing yearly by 10% over the past 25 years. However, payment digitalisation has shifted many autogiro users to the digital version of setting up new direct debit mandates, saving them significant time and effort. Apart from augmenting conversion rates, autogiro will continue to be the perfect payment method for prolonging customer lifetime value.

Download a complete Digital Autogiro Infographic

Download a complete Digital Autogiro Infographic

As Digital Autogiro providers, we’ve seen significantly improved conversion rates among our merchants. The ease of signing up for new monthly payments and subscriptions positively impacts retention rates too, as there is no action required once users sign up for monthly withdrawals. Our merchants report conversion rates between 42 and 79%, as well as retention rates ranging from 84 to 93%. In 2023, Digital Autogiro will help more brands in acquiring new customers thanks to pre-filled forms accessible directly on their mobile phones, ready to sign safely in a few simple steps.

5. Subscription packages are set to grow by a further 190 billion euros

The subscription business model has been around for centuries but the European subscription market has never been bigger. An average European spends 5% of their salary on monthly subscriptions, which accounts for 350 billion euros spent yearly just in Europe. The subscription business model is still gaining momentum and is expected to grow by a further 190 billion euros, as consumers prefer the pay-as-you-go approach over paying for services in advance. The customer lifetime value tends to increase whenever services or products are packaged as a subscription when compared to one-time payments. Additionally, merchants get the opportunity to increase the valuation of their company as they secure a recurring income.

The upcoming economic uncertainty will result in more businesses packaging their products as subscriptions to cater to their audience’s needs. Significant players like BMW and Mercedes-Benz have already incorporated subscription services into their strategies, which proves that even the world's biggest companies are entering the subscription business model because of its growth potential.

Do you have questions regarding the payment trends of 2023? Or maybe you want to find out more about Digital Autogiro? Make sure to contact us!

.png)