At Waytobill, we're passionate about transforming how businesses manage payments. Our key focus is on facilitating a significant shift from traditional invoicing to direct debit recurring payments, alongside digitising the residual invoicing processes. This strategic shift not only streamlines operations but also enhances the sustainability and profitability of businesses.

Increasing Customer Lifetime Value

Transitioning customers from invoice to direct debit has been shown to extend customer retention significantly. For services that require recurring payments such as insurance, subscriptions, and memberships, switching to direct debit can increase customer lifetime value by 25-50%. For instance, a typical four-year customer relationship can be extended to five or six years, markedly boosting profitability in any subscription-based business model.

Boosting Activation and Payment Rates

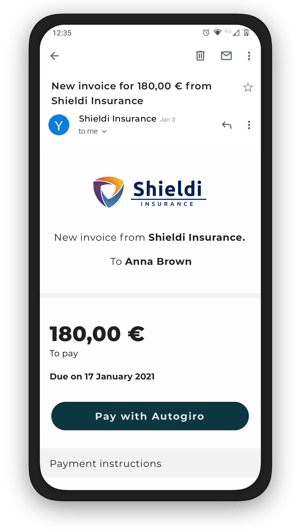

Direct debit simplifies the payment process, leading to higher conversion rates. Typically, conversion rates for services using invoices hover around 80%, with a loss of potential customers who fail to complete their first payment. Direct debit, however, almost guarantees the first payment, pushing activation rates up to approximately 95%. This method not only improves sales by almost 20% but also maintains a higher ongoing payment rate, thus enhancing both liquidity and customer satisfaction.

Reducing Administrative Burdens

The traditional invoicing process involves significant administrative overhead, including distribution, printing, and manual account management tasks. These activities are costly and error-prone, often resulting in additional customer service and corrective actions. According to Levvel Research, processing a single, manual invoice costs most companies an average of up to €15. By adopting direct debit, businesses can reduce these costs by up to 80% or €12 per invoice, streamlining accounts receivable processes and virtually eliminating payment errors.

Contributing to Environmental Sustainability

Producing and delivering paper invoices has a negative impact on the environment that can be easily eliminated. Every paper invoice that is substituted by a digital payment saves about 36 grams of CO2 emissions, contributing positively to environmental sustainability. Digitalising payments isn't just a financial decision but also a step towards a more sustainable planet.

Cost-Effective Investment

Investing in digital payment solutions through Waytobill is both cost-effective and value-adding. Typically, the costs associated with our digital payment services are a mere fraction (about 10%) of the value they create, making it a prudent investment towards achieving greater efficiency and reduced administrative costs.

Switching to direct debit is not just a payment simplification strategy—it's a comprehensive improvement to your financial operations, enhancing customer relationships, reducing costs, and supporting environmental goals.

Join Waytobill in revolutionising payment processes and paving the way for a more efficient and sustainable future. For more information and to learn how to optimise your payment processes, feel free to contact us today!