In today’s dynamic business landscape, companies and organisations spanning diverse industries are driven by a common goal: optimising costs, enhancing conversion rates, and boosting revenue streams. So if you’re feeling exhausted from managing and dealing with issues related to invoices, like constantly chasing late payments, and engaging in endless back-and-forth communications, we’ve got news for you: it’s time for a transformative change.

By transitioning your insurance clients to direct debit, you not only optimise costs but also streamline your business processes significantly. In this comprehensive guide, we will take you step-by-step through the process of moving your clients to direct debit, from recognising the numerous benefits to seamlessly implementing the payment method. Let’s dive in!

What challenges do insurance companies face due to invoice-based clients?

Working with clients relying on invoices presents a multitude of challenges for insurance companies, leading to increased administrative workload and reduced operational efficiency. The burden of following up on overdue payments consumes valuable time and resources, hindering the company’s productivity. Moreover, persistent issues related to late payments can strain the relationship between the insurance company and its clients who may become dissatisfied if they face constant reminders or penalties for late payments. It’s also important to remember that in a competitive market, offering flexible and convenient payment methods, such as direct debit, can be a competitive advantage. Insurance companies relying solely on invoices may lose potential clients to competitors offering more convenient payment options.

How insurance companies can optimise results through direct debit

Direct debit is a recurring payment method that automates the process of withdrawing payments from a client’s bank account and depositing them directly into the payee’s account. Once set up, direct debits don’t require any further action to be taken by either party unless the client decides to cancel their policy or the company discontinues coverage. Opting for direct debit offers insurance companies a multitude of advantages:

- Efficiency and time allocation: By transitioning clients to direct debit, the need to chase missed payments diminishes, freeing up valuable time and resources for the administrative team, and allowing them to focus on more crucial tasks within the organisation.

- Reduced late payments and churn: since payments are automated, the likelihood of late payments significantly minimises, leading to lower involuntary churn caused by missed payments. This not only stabilises revenue streams but also improves customer satisfaction.

- Improved retention and lifetime value: direct debits offer unparalleled convenience to customers, providing peace of mind. When payments are hassle-free, customers are more likely to renew their policies, which improves retention and LTV.

- Elevated customer experience: Eliminating the need for clients to remember due dates or manually settle payments fosters improved satisfaction and loyalty. The streamlined payment process enhances the overall customer experience, reinforcing their trust in the insurance provider.

- Steady cash flow: Direct debit ensures a consistent and predictable flow of funds as payments are automatically deducted from customers’ bank accounts. This predictability helps insurance companies manage their cash flow more effectively.

Find out more about the benefits of using direct debit for insurance companies.

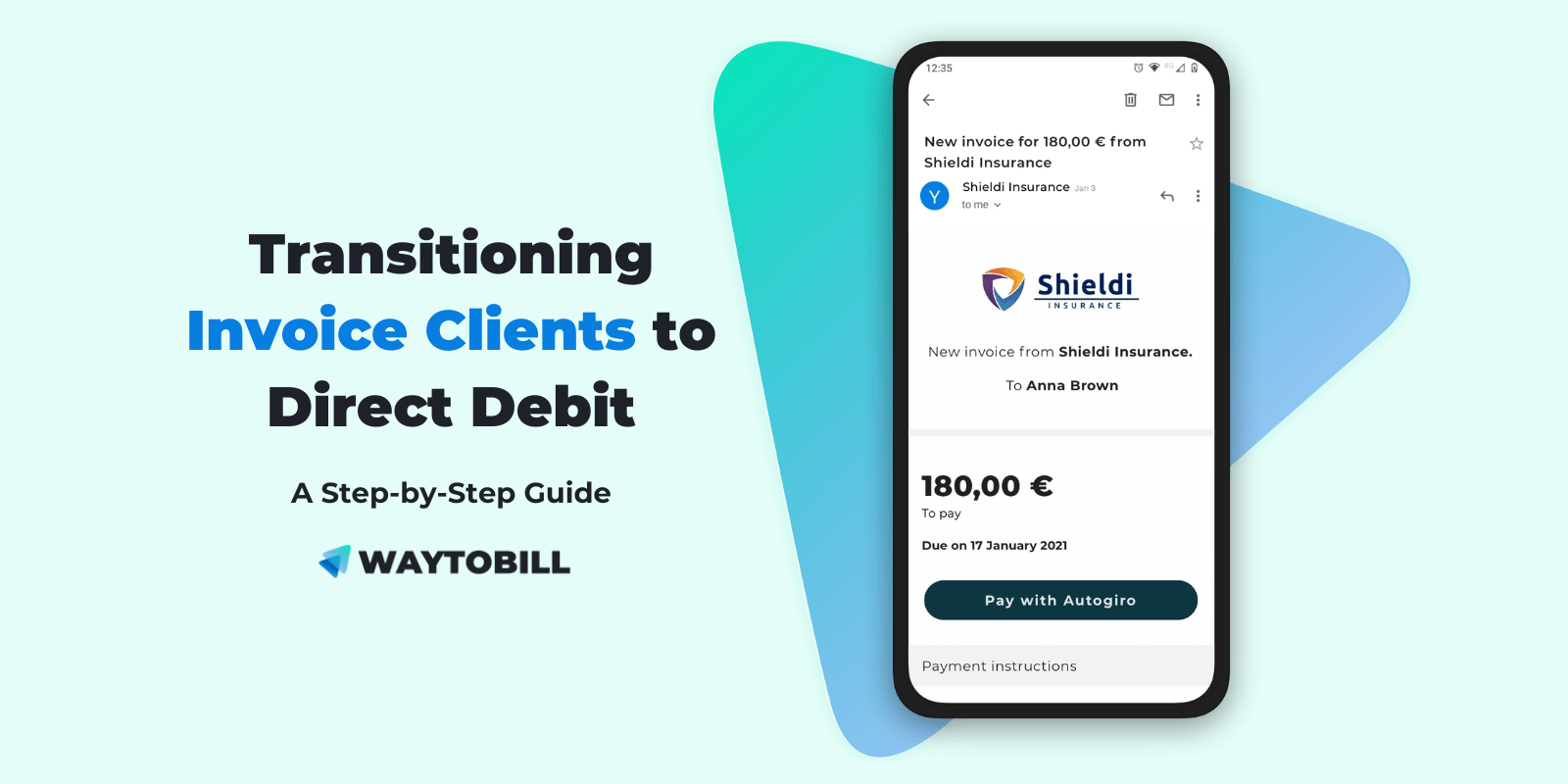

Multi-Channel Invoicing: the easiest way for insurance companies to switch invoice clients to direct debit

Transitioning insurance customers from traditional invoices to direct debit might seem daunting, however, with Waytobill’s innovative Multi-Channel Invoicing, the process becomes efficient and straightforward. Multi-Channel Invoicing, our structured approach to invoice delivery, enables insurance companies to engage clients across various platforms, all geared toward one ultimate goal: transitioning clients to automatic recurring payments.

Understanding Multi-Channel Invoicing:

Waytobill offers multiple distribution channels tailored to diverse client preferences:

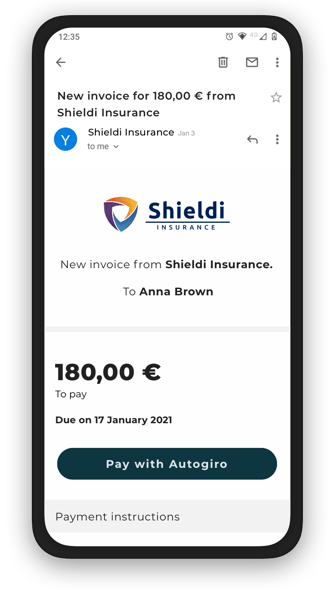

- Digital mailbox - Utilise platforms like Kivra, reaching over 5 million users, and allowing clients to access invoices seamlessly. Add a “pay with direct debit” button for instant conversion to direct debit.

- e-Invoice - Directly notify customers through their bank accounts, enabling them to settle payments via mobile banking apps and switch to Digital Autogito or Digital AvtaleGiro.

- Email with payment button - Send invoices as PDF attachments with an option to switch to direct debit. Emails are widespread across different demographics and the process is fast and convenient.

- Paper invoice - For clients accustomed to physical invoices use traditional paper billing. Enhance this method by integrating personalised QR codes. By scanning the QR code, clients will be redirected to an online checkout where proceed to a secure online checkout for direct debit confirmation.

.webp?width=506&height=516&name=Insurance%20visuals%20-%20Invoice%20with%20Autogiro%20QR%20code%20-%20magnified%20and%20blur%20overlay@2x%20(1).webp)

Interested in learning more about the use of QR codes in transitioning invoice clients to direct debit? Head to our blog post titled How to use QR codes for invoice to direct debit transitions for insurance companies.

Educate your customers about the convenience and security of direct debits

The key to transitioning clients from invoice to direct debit lies in transmitting the information that will help your clients make the decision to change their payment method. Help them understand the benefits of direct debit and why it is a more efficient and cost-effective option. Highlight that with direct debit they will be able to:

- Mitigate any unexpected fees for late payments

- Have a continuous policy and no suspension of coverage due to late or missed payments

- Have peace of mind since direct debit payments require clients to take no action

- Proceed with a secure payment method since the payments are done automatically and there’s no need for third-party integration

- Enjoy flexibility as the direct debit due date can be changed if needed

Provide incentives for direct debit adoption

If some of your invoice clients are more hesitant than others, consider offering attractive incentives that make the transition worthwhile. For example, you could offer special prices or discounted insurance add-ons, like free road assistance for a car insurance company, or free checkups for pet insurance.

Offer a seamless onboarding process for direct debit with Waytobill

Switching customers from a traditional payment method to a digital payment must be easy and pretty straightforward even for the not-so-tech-savvy clients. This is why simplifying the onboarding process and providing clear instructions is crucial.

Luckily, Waytobill provides a seamless onboarding and customer experience for anyone opting for direct debit.

For example, the QR codes printed on paper invoices are personalised. What does it mean? By scanning the code, the user will be redirected to an online checkout pre-filled with the client’s information available in your sales or CRM system. This allows for a seamless checkout experience since the client doesn’t have to fill out long forms and provide detailed information. On the contrary, the customer simply reviews the information to make sure that it is correct. Then, they confirm the direct debit mandate by using their BankID and… they’re ready to go! The same straightforward process goes for electronic invoices or emails with payment buttons.

Waytobill seamlessly integrates with your existing systems

As mentioned in the previous section, Waytobill integrates with various sales and CRM systems, allowing you to access payment-related information directly from the software you’re used to working with. This eliminates the need for training and mastering a new tool. Find out more about our CRM and telesales integrations.

Are you ready to switch your insurance clients to direct debit? Make sure to contact us in case of questions or doubts - we’re more than happy to help, assist, and advise!