It's no surprise that businesses and organisations offering subscription-based services look for payment solutions that can boost customer lifetime value. However, enterprises must prioritise customer acquisition before focusing on customer lifetime value. Interestingly, seamless payment solutions have a great impact on conversion rates, as the more convenient payment methods reduce entry barriers. Many enterprises turn to direct debit as their go-to choice for recurring payment methods due to its ease of use. However, traditional paper-based Swedish autogiro mandates often lead to low conversion rates due to the complexity of the form, especially in direct sales scenarios such as telesales and field sales. Additionally, customers frequently make mistakes when filling out the form, resulting in a longer and more complicated sign-up process.

Moreover, every subscription business owner understands the value of each paid order and increasing conversion rates directly translates to higher recurring revenue. So, how can we leverage autogiro while ensuring an increase in conversion rates? The answer lies in Digital Autogiro.

What is autogiro in Sweden?

Autogiro is a recurring payment method (direct debit) used in Sweden, which automatically withdraws funds from the customer’s account on the due date. Unlike traditional invoices, autogiro requires no further action from the payer or payee. As subscription businesses continue to gain popularity, autogiro has become a preferred payment method for many customers. To enable autogiro payments, businesses require customers to sign an agreement known as an autogiro mandate, either through a web-based form or paper form.

The primary advantage of autogiro lies in its convenience, with recurring payments seamlessly withdrawn from customers' accounts on the due date. However, the sign-up process itself can be complex and time-consuming. Here are some common issues associated with traditional paper autogiro mandates:

- Lengthy forms - the forms require the end-user to provide extensive personal and payment information, prolonging the process beyond what many customers desire.

- Potential mistakes - customers may accidentally provide incorrect information, further extending the sign-up process, especially when using paper mandates. In some cases, clients send signed paper forms to the service provider without realising a signature was missing. This necessitates the company sending the form back to the customer for completion and subsequent return.

- Lack of instant confirmation - since customers submit forms via email or post, they don't receive instant confirmation or immediate access to the service.

According to Waytobill's study, a majority of responders found the traditional autogiro mandate sign-up solutions overly complicated. Participants highlighted the excessive number of steps involved, often resulting in customers being unable to complete the process until much later due to receiving the form after the initial call or by post.

Consequently, the motivation to finalise the payment diminishes, adversely affecting conversion rates. This emphasizes the need for a user-oriented solution that is quick and easy for customers to use, ultimately leading to increased conversions. Here's where Waytobill's Digital Autogiro comes into play.

Digital Autogiro by Waytobill - the new solution for autogiro mandates

Autogiro is a powerful payment method in Sweden. It allows customers to sign up for recurring payments that are automatically withdrawn from their accounts, giving them peace of mind whenever opting for monthly subscriptions or donations. It's also the perfect solution for businesses that get to retain customers for longer and augment customer lifetime value. Waytobill's Digital Autogiro delivers all these aspects while also providing convenience.

Waytobill's Digital Autogiro can be used across all sales channels:

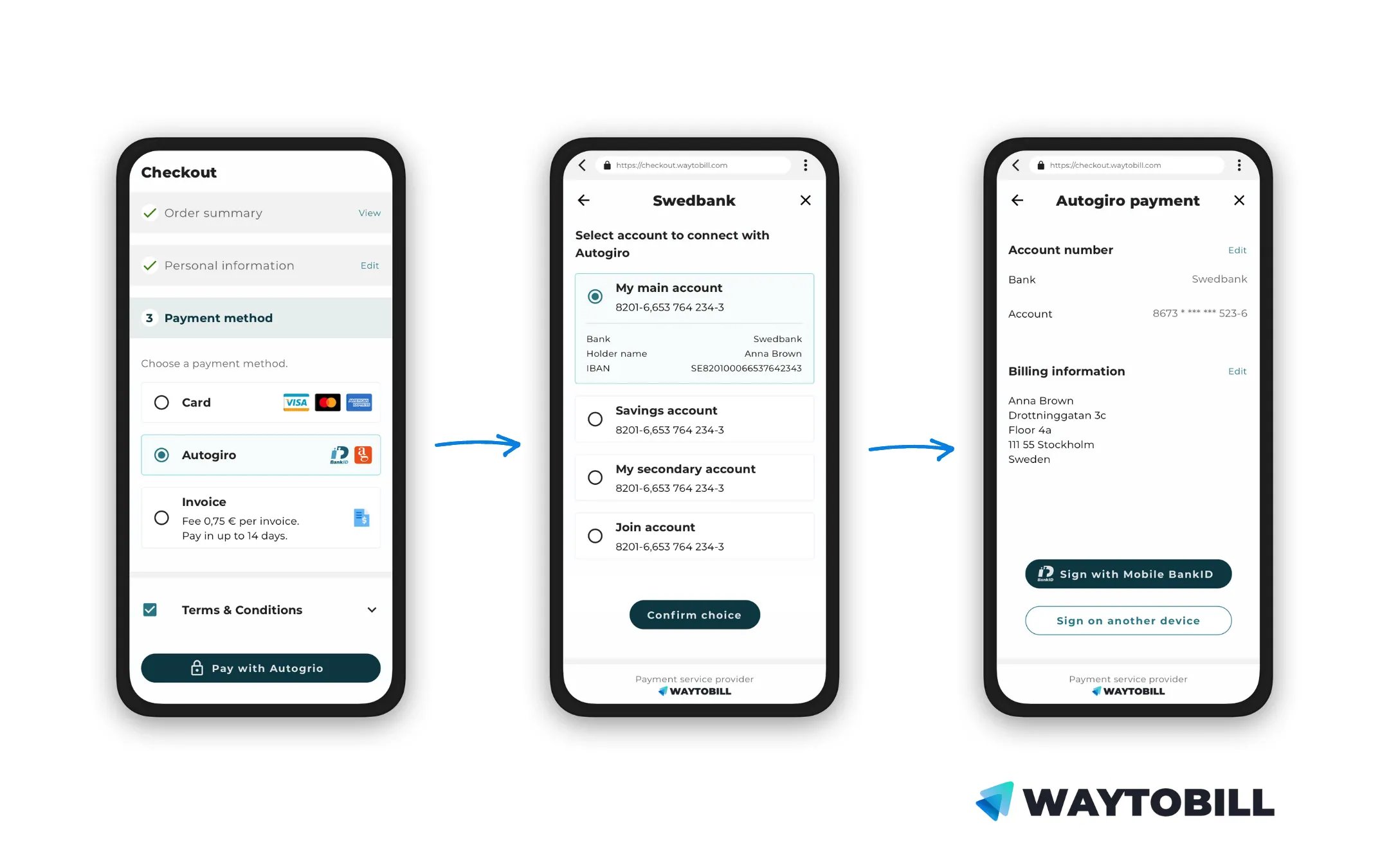

- Telesales: customers who agree to sign up for a product, service, or donation over the phone, receive a text message with a payment link that takes them to an online checkout pre-filled with their personal information gathered during the call or pulled from the telesales system. The client confirms if the information is correct and chooses their preferred payment method to confirm the agreement and pay for the order. Learn more about the telesales checkout.

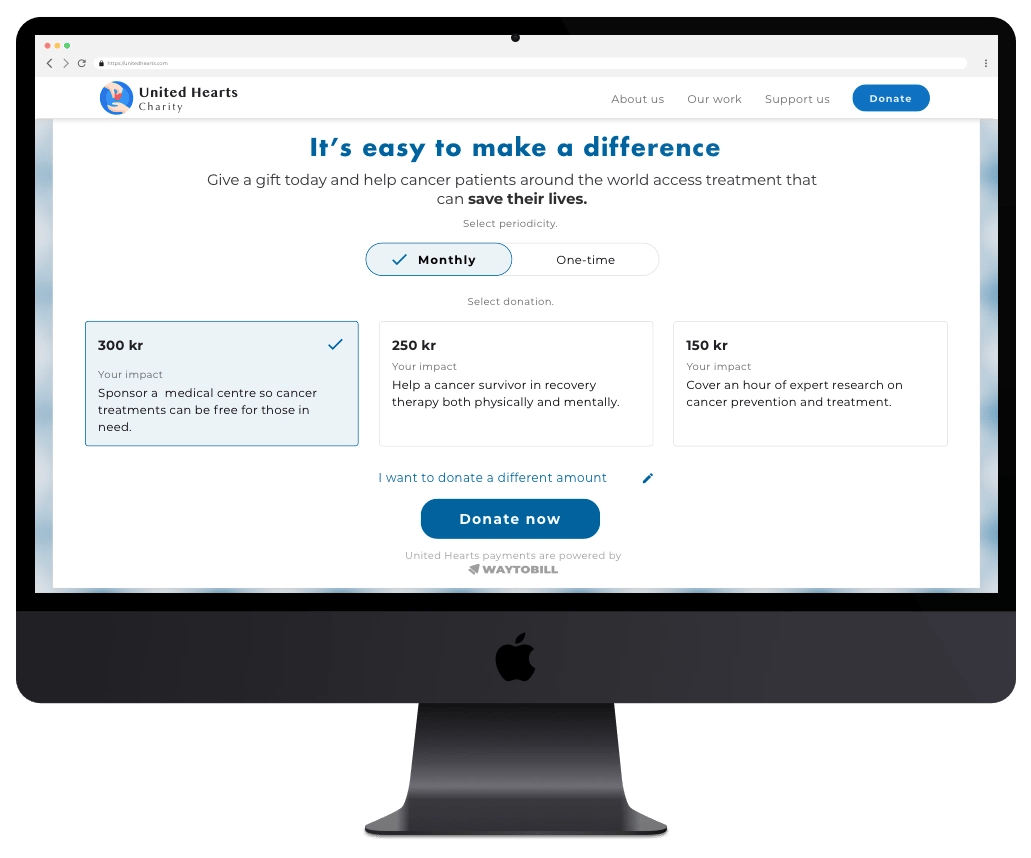

- Online: businesses and organisations can embed Waytobill's online checkout onto any page of their website. Users fill in the short online form and use their BankID to set up autogiro mandates in seconds. Learn more about our online checkout with Digital Autogiro.

- Field sales: potential clients scan QR codes printed on leaflets, posters, or presented by promoters on tablets and open an online checkout where they can sign up for the service or donation. Learn more about using QR codes to drive customers to your checkout.

With Waytobill, the hassle of filling out a huge form is out of the picture. Instead, when it comes to telesales, the customer’s information is sent from the sales system which reduces possible errors and simplifies the process. Additionally, we use BankID to fetch customers' account information in a safe and convenient way. Our user study confirms that this process is seen as easy and quick, which together with feeling secure are three important attributes people pay attention to when proceeding with digital payments.

Why use Digital Autogiro for your business?

Autogiro is a very modern payment solution for recurring payments, especially when you compare it to other payment methods. For example, invoice payments are much more complex, as the payee must issue a new invoice every month, while the customer must take a moment to open the invoice, go through it, and complete the payment. You may ask: what about card payments? They can be recurring too, right?

Yes! But do remember that credit cards expire. This means that the payment will be voided and the customer will be asked to provide new card details and that does not always happen. Hence direct debit is the best payment method for increasing customer lifetime value and boosting retention.

Would you find out more about Digital Autogiro? We've collected all the important information in an infographic. Download it now to learn all about this new payment option.

Increase conversion rates with autogiro in Sweden

As mentioned earlier, customers highly value attributes such as ease of use, speed, and seamless experiences when it comes to online payments.

Therefore, to boost your conversion rates, it is essential to prioritise these values at the heart of your checkout process. We have observed that many merchants face a common challenge: low conversion rates when using traditional autogiro solutions. In certain segments, as much as half of the customers abandon the payment process. This clearly indicates that lengthy and complex web-based or paper forms are hindering merchants from maximising their conversion potential through autogiro. Considering the potential for substantial growth and the immense value in even small percentage increases, addressing this issue becomes crucial.

With Waytobill's user-friendly checkout solution, you can significantly enhance your conversion rates for autogiro payments and remove barriers for your customers, effectively, transitioning them from leads to paying customers. Contact us today to learn more about how to get started with Digital Autogiro!