Creating a new charity is a huge challenge that, in many cases, demands more time and planning than expected. And once you’ve dealt with all legal aspects and paperwork, the next crucial step is earning the trust of your target audience. While effective messaging and communication are vital, there are other key factors that will also determine the success of your organisation and its ability to help those in need.

One important aspect that should not be overlooked is choosing a trustworthy payment provider. Opting for a reliable and secure solution can cultivate loyalty and trust, which will greatly impact your fundraising results.

In this blog post, we take a look at how to choose the right payment provider for your charity and what to look out for.

Benefits of choosing the right payment provider for your charity: enhanced donor trust and a boost in donations

Trust plays a fundamental part when it comes to your charity’s success. Without trust from your target audience, your fundraising activities won’t lead to desired results and therefore you won’t be able to accomplish your mission.

In today’s society where more and more purchases are taking place online, customers and businesses look for secure payment systems in order to protect their interests. The same applies to charity donations. By opting for a secure payment provider for your charity you can significantly increase donor trust for several reasons:

- Data protection: financial information is highly sensitive and so your charity must protect the data of your donors. Secure payment providers like Waytobill encrypt all the financial data and protect it from unauthorised access, making donors feel confident that their information is being handled securely.

- Prevention of fraud and identity theft: trustworthy payment providers employ security measures to prevent fraudulent transactions and protect donors from potential identity thefts. A great example of such protective measures is Waytobill’s Digital Autogiro payment method (Swedish direct debit), which allows donors to electronically confirm their identity by using their BankID.

- Compliance with industry standards and regulations: reliable payment providers are likely to comply with industry standards and regulations. This helps your charity protect donor data, identity, and money.

- User-friendly experience: you can recognise a reputable payment provider by testing their checkout. It’s always a good sign if the experience is seamless and user-friendly, as the donation process will be easy and straightforward. A positive donation experience positively impacts your donors, further boosting trust and opening up the door for future financial contributions.

.webp?width=2398&height=1110&name=Autogiro%20flow%20-%20updated@1x%20(1).webp)

- Positive word-of-mouth referrals: when donors have a positive experience with your charity’s secure checkout, they are more likely to share it with others. Positive word-of-mouth recommendations can bring in new donors and as a result, your charity may see an increase in donations from both existing and new supporters.

- Reduced friction in recurring donations: for charities that rely on recurring donations payment providers can facilitate the setup and management of recurring payments. For example, with Waytobill’s Digital Autogiro, donors who commit to ongoing financial support don’t have to take any further action in order to donate to their favourite charity.

Consequences of choosing the wrong payment provider for your charity

Non-profit organisations can choose from a wide range of payment providers available on the market, however, the trick lies in choosing secure and trustworthy options. NGOs are often on a tight budget, trying to make the most of their funds. However, opting for the cheapest choices may not always be the right selection. This doesn’t mean that you can’t find an affordable and secure payment provider. For example, at Waytobill, we offer attractive options and our payment system is highly secure and has been trusted by important industry players.

But let’s go back to the possible consequences of choosing the wrong payment provider for your charity:

- Lost donations due to payment processing issues: sparking interest within your target audience is the very first step to converting new supporters. Once your potential donors are willing to donate money and help your charity, it’s time to drive them to your checkout, whether it’s online, over the phone, or in person. If the checkout isn’t smooth, intuitive, and easy to navigate, there is a high chance that your prospects will abandon it. The same applies to long loading times and processing errors.

- Damage to your charity's reputation: positive checkout experience is crucial for converting and retaining donors. Stumbling upon issues when trying to donate will lead to abandonment and churn in donations and negative word-of-mouth won’t do you any favours.

Why choose Waytobill as a payment provider for your charity

You probably know by now that choosing the right payment provider can have a great impact on your charity’s success and fundraising. Luckily, there are solutions that can help you maximise fundraising and tap into customer trust and loyalty thanks to a seamless and positive experience. Waytobill is one of those solutions. And here’s why you should choose Waytobill as your next payment provider:

1. Integration options and ease of implementation

Waytobill’s checkout and charity plugin can be easily integrated with your telesales or CRM system so that you can take full control of the payment cycle. We’re already integrated with various systems and we’re constantly working on adding integrations with other telesales and CRM tools.

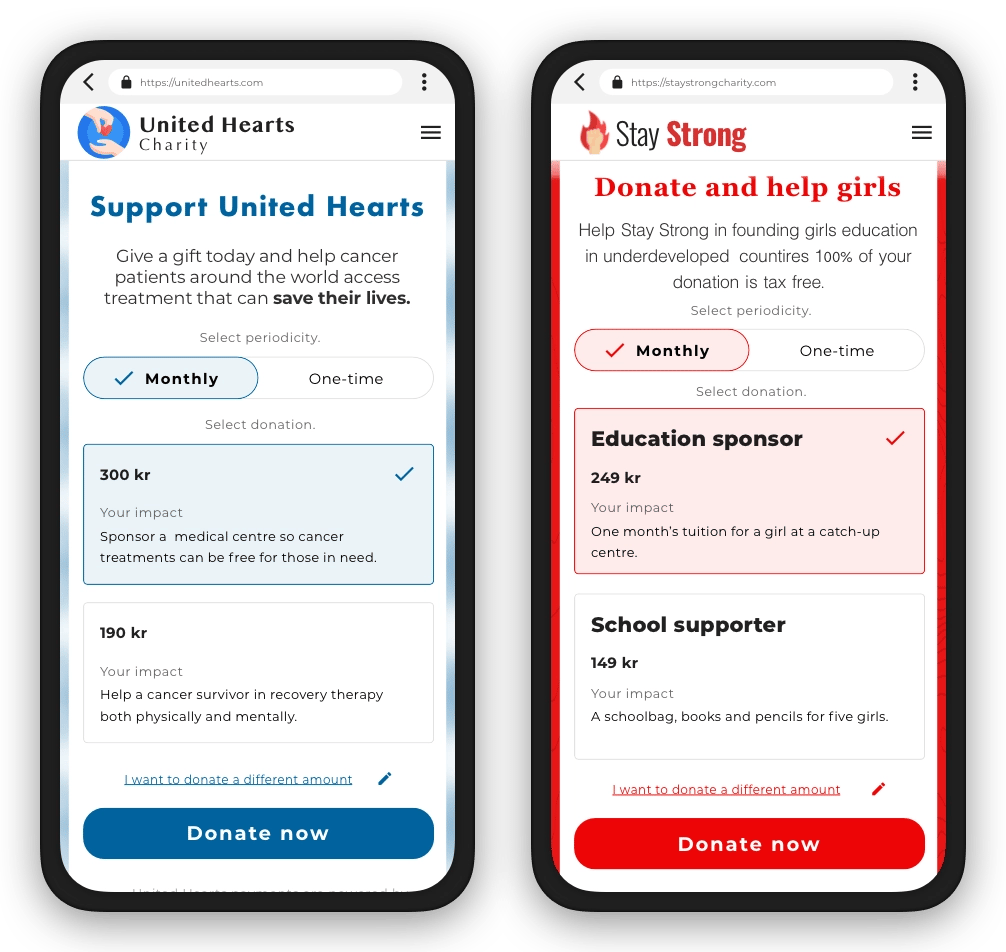

2. Customisation capabilities to match your charity's branding

We’ve covered how important it is to create a feeling of trust so that donors can become loyal and most importantly, support your organisation long-term. One of the easiest ways to do it is to ensure that the payment process forms part of the corporate image of your organisation. With Waytobill, you can display your logo in the checkout, as well as customise the charity plugin's appearance by changing colours, buttons, and texts. This makes the Waytobill charity solution part of your website and delivers a more positive user experience.

Take a look at the above examples to see how you can customise Waytobill’s charity plugin. These options help you significantly improve user experience and tap into customer loyalty.

3. Transparent pricing structures

Hidden costs are the very last thing you want for your charity. This is why we’re fully transparent with our pricing! Get started on one of our plans or request a tailored offer.

4. Security, data protection and compliance

We take security very seriously. We strictly follow GDPR regulations on data protection and work closely with authorities. When signing agreements with Waytobill, customers confirm their identity via BankID, which protects them even further.

5. Request a demo to see the checkout in action

We know how important it is to clearly understand the product before committing to it. This is why, at Waytobill, we’re more than happy to offer you a non-committal demo session in which we will guide you through the checkout process and the different payment options available. Our team member will answer all your questions and make sure that you receive all the information you need to make a well-informed decision.

6. Technical support and issue resolution

Errors happen, issues arise, and problems must be solved - that’s the reality, although we make our best to reduce the number of possible problems! However, if you ever need technical support or issue resolution, our dedicated team will do their best to help you solve the problem as quickly as possible.

Do you have more questions about payment solutions for your charity? Or maybe you’d like to test our checkout for yourself? Reach out to us and let us help you take your non-profit to the next level!