To continue making a change, charities require constant financial support from donors. Steady funding is one of the most significant challenges faced daily by non-profit organisations, as they try to maximise their fundraising activities. Today, we look at how to leverage different payment methods for charities and thus increase retention and conversion rates for your non-profit organisation.

Charities of all sizes depend on donations from the public. Unfortunately, these have been tremendously affected by the pandemic and current economic downturn, resulting in fewer contributions donated to charities and non-profit organisations. According to some reports, the charitable sector could reach a funding gap of £10 billion, leaving charities and their beneficiaries in real trouble. Non-profits worldwide are now looking for new fundraising tactics, adapting their strategies, and researching solutions that can help them stay afloat and continue their mission of good-making. And although one-off donations and text-to-give campaigns are popular among non-profits and donors, they’re not a steady source of funding. Hence opting for online recurring payment methods is crucial for your charity and a significant step towards securing regular donations and financial stability.

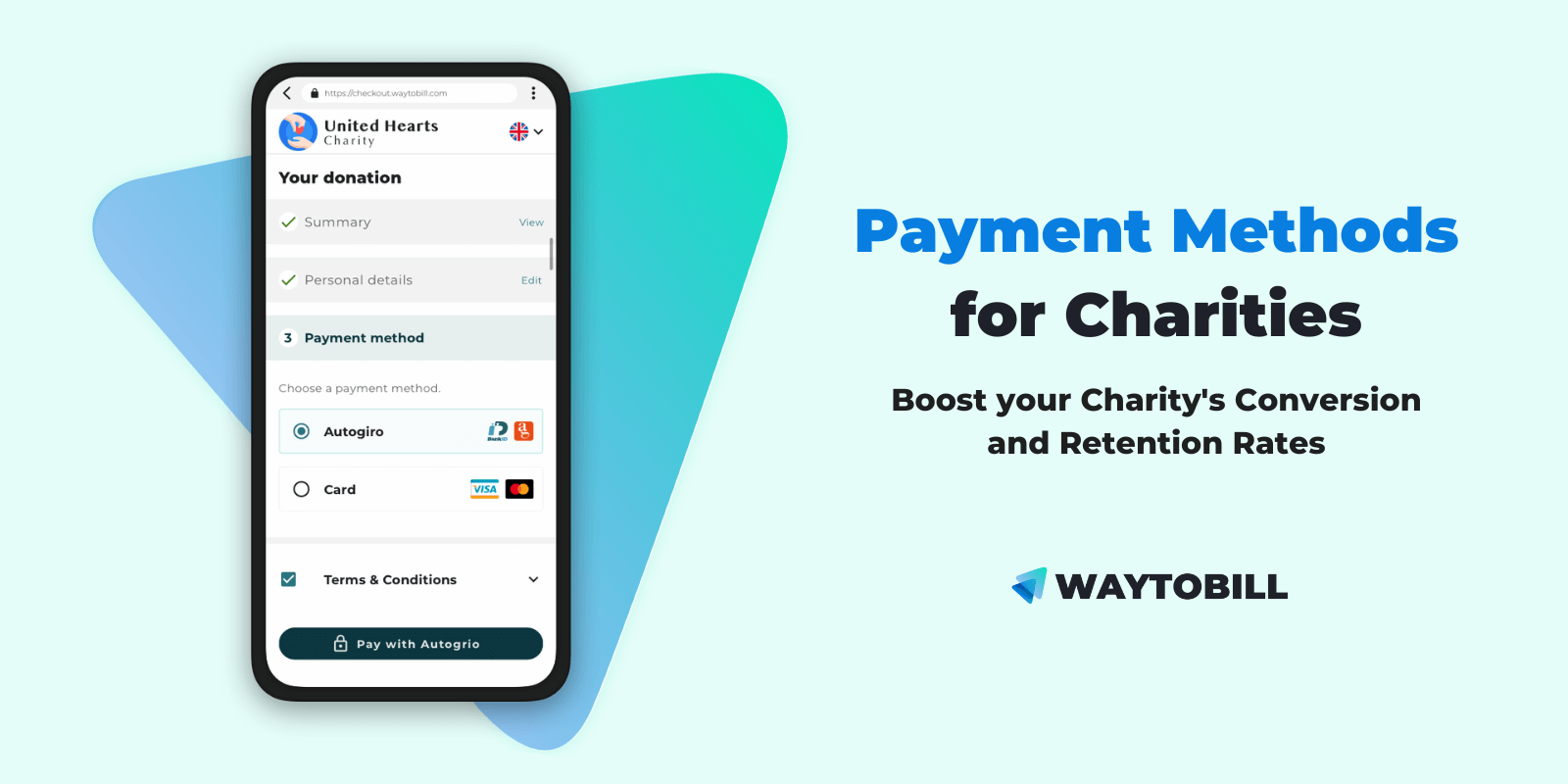

We will now take a closer look at different digital payment methods that charities can implement into their strategy, facilitating the donation process for potential supporters and thus growing conversion rates. Some of them come with automatic monthly withdrawals, with the ultimate goal of improving retention rates.

Increase charity donations by facilitating convenient payment methods

Over the past years, charities from all over the world have been driven to modernise the donation methods available to existing and potential donors; non-profits have facilitated card and Paypal payments and implemented text message donations in order to retain existing donors and attract new supporters. The cashless society forced non-profit organisations to offer donors their preferred payment methods, which combined with all the information necessary to make an informed decision, open up the door for new sales opportunities.

Here are the three most popular and secure payment options that will help you sign up monthly donors in no time.

1. Modernise and automate charity donations with direct debit

Digital Autogiro is a Swedish direct debit that permits you to sign up recurring donors without the need for time-consuming paper forms, which often happen to be boresome and discouraging. By simplifying the registration procedure, you eliminate entry barriers and increase donor conversion and retention - no effort is required from your newly signed-up donors in order to complete future payments. The Waytobill’s Digital Autogiro is integrated with popular telesales and CRM systems, enabling your telemarketing teams, street collectors or online checkouts to bring sales to completion.

How does Digital Autogiro work?

If you opt for Waytobill’s payment methods for charities, all the users who become your charity donors can choose Digital Autogiro as their preferred payment method, even when it comes to telesales. They securely connect to their bank account and select an account they want to pay from. They are then redirected to BankID to confirm their identity and sign up for a new Digital Autogiro mandate. The Digital Autogiro is the easiest way of increasing retention rates and improving donor lifetime value as there are no barriers like card expiration dates or unpaid invoices.

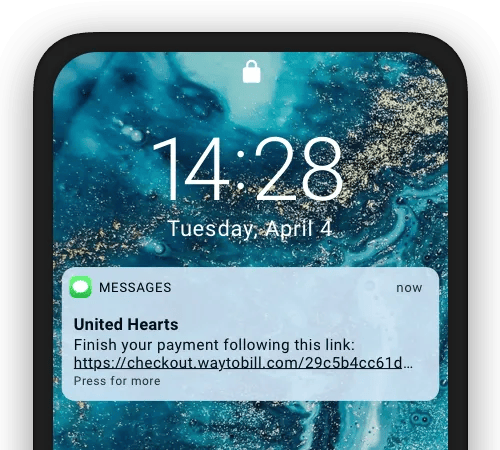

Digital Autogiro also happens to be a convenient payment method for charities that opt for fundraising telemarketing campaigns. You may know that in the telesales approach, many potential donors drop off when it comes to completing the payment. With Digital Autogiro, you can save up to 50% of these potentially lost orders, as agents can send payment links directly to the prospect's mobile phone.

2. Credit or debit card payments as payment methods for charity donations

Digital Autogiro may not be the preferred payment method for some of the donors of your charity, and that’s why offering various payment options is a crucial aspect of your charity’s success. Some people might proceed with a debit or credit card payment for comfort reasons (many devices store card information for faster payments).

Offering card donations will allow you to build up your monthly funding due to automatic monthly withdrawals. It’s also one of the most popular payment options worldwide, making it a safe choice for many online users.

3. Digital payment methods for charities: digital invoices

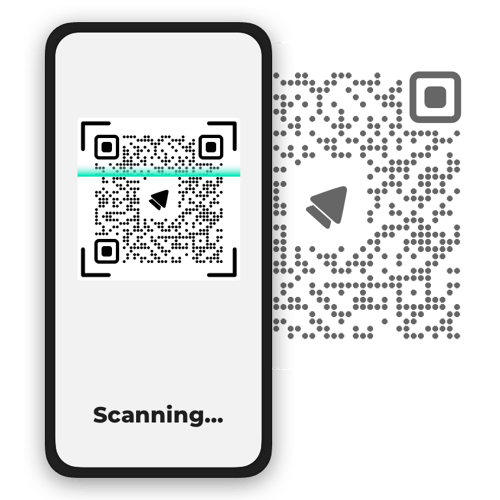

Invoices are still a prevalent and preferred payment method for many charity donors, especially the older segments of your audience. Your charity donors can choose to receive a digital invoice which can be paid at their local bank branch or by opening up their mobile banking app. You can also add QR codes to your invoices; donors can scan a QR code with their mobile devices to be redirected to secure online checkout. QR codes can be also used to convert invoice donors to Digital Autogiro so that you can increase donor lifetime value and retention.

Are you interested in convincing your database to move on to modernised payment methods? No problem! Waytobill allows you to change your donor’s payment method easily and smoothly.

Are you interested in finding out more about digital payment methods for charities? Make sure to contact us in case of doubts or questions and we’ll be more than happy to assist you!